Understanding LA Pay Error Codes

When processing payments in LA Pay, users may occasionally encounter error codes that disrupt transactions. In this blog, we'll cover some of the most common LA Pay error codes, explain their meanings, show how to find more details in the Merchant Track Portal, and provide practical steps to resolve them.

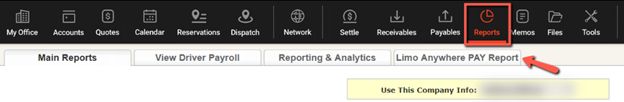

Accessing the Merchant Track

- Click the “Reports” icon from the Navigation Bar.

- Select the “Limo Anywhere PAY Report” tab.

- The Merchant Track Portal will open in a new tab. Note: Note: If you encounter a white screen with no new tab opening, make sure to "Allow Pop-ups." The option to allow pop-ups is typically found at the end of the address bar.

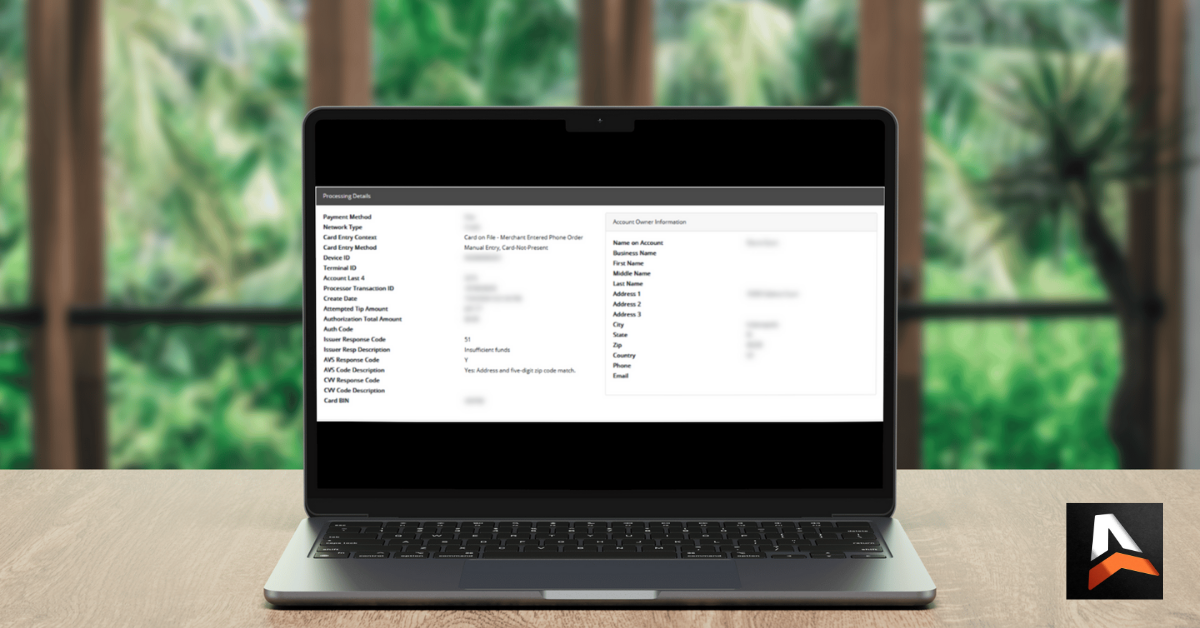

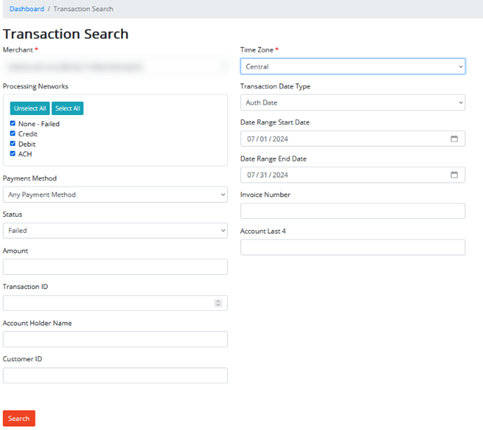

Viewing Transaction Details in the Merchant Track

- In the Merchant Track tab, click the “Transaction Search” icon from the lefthand menu.

- Enter your search criteria in the Transaction Search screen.

3. Click on the Transaction ID you want to review.

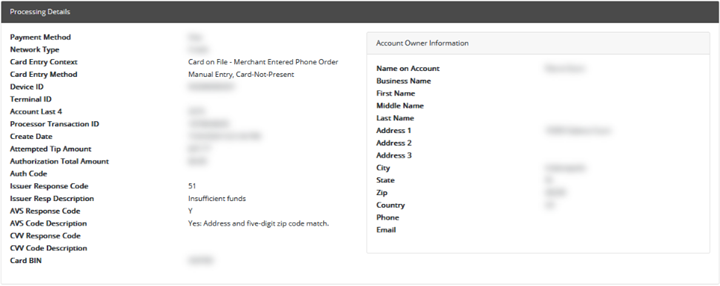

4. Scroll to the Processing Details section to view the decline information in the Issuer Response Code and Description.

Error Codes

1020 Declines

These declines can occur for various reasons. If you encounter a 1020 decline, it's crucial to check Merchant Track to identify the specific type of decline. Remember, avoid attempting the card more than three times within 24 hours to prevent raising red flags with the processor and card brands, which could affect your ability to continue processing transactions.

- 05 – Generic Authorization Declines

Contact the cardholder to check the reason for the decline. You may also ask them to consult their card issuer or bank. Re-enter the credit card data or send a payment link for the customer to input their card information directly. - 59 – Suspected Fraud Declines

Reach out to the cardholder for more details. Suggest they verify with their card issuer or bank. Re-enter the credit card data or send a payment link for the customer to input their card information directly. - 61 – Exceeds Withdrawal Limit

This error indicates that the transaction would lower the customer’s bank balance below the limit set by their bank, or they have exceeded their daily transaction limit.

Advise the customer to use an alternative payment method. - 51 – Insufficient Funds

This indicates that there were insufficient funds available to complete the transaction. Advise the customer to use an alternative payment method. - 46 – Undocumented Issuer Response

This means the card is no longer active because the account associated with it has been closed. Ask the customer to use a different payment method. - 30 – Message Format Error

This occurs when an American Express (AMEX) card’s CVV/security code is incorrectly entered as a 3-digit code instead of 4 digits. Re-enter the correct 4-digit security code.

1101 Errors

- 1101 – Processor Invalid Data Response – INVALID CARD INFO

This error indicates that the card information entered is not valid.

Re-enter the credit card data or send a payment link for the customer to input their card information directly.

Error Code 10

This error can occur for various reasons.

- Payment Gateway Conflict: Error Code – 10. The request did not pass validation and could not be processed.

Example: The CardNumber field is not a valid credit card number. The field CardNumber must be a string with a minimum length of 12 and a maximum length of 19. Re-enter the credit card data or send a payment link for the customer to input their card information directly.

1103 Errors

- Payment Gateway Conflict: Error Code – 1103. Fullsteam received an Invalid Request response from the processor.

This happens when the processor deems some data invalid.

Double-check the credit card data you’ve entered, including the billing address. Ensure the address information is correct, such as placing the Suite# or Apt# in Address Line 2 instead of Address Line 1. If issues persist, re-enter the credit card data or send a payment link for the customer to input their card information directly.

1105 Errors

- Payment Gateway Conflict: Error Code – 1105. The card number or card type submitted is invalid. You may not be configured to process the card type.

This error can occur if the card isn’t set up to be processed under LA Pay terms.

Attempt to send a payment link to mitigate the issue. If this doesn’t resolve the problem, advise the cardholder to contact their issuing bank or provide an alternative form of payment.

1024 Errors

- Payment Gateway Conflict: Error Code – 1024. Transaction declined – The card issuer requests the merchant to pick up the card.

This occurs when the cardholder has reported their card as lost or stolen to the issuing bank. Advise the cardholder to provide an alternative form of payment.

If you have any questions or need further assistance, please feel free to reach out to our Support team at Support@LimoAnywhere.com or call us at 888-888-0302 x2.